This month, we’ll be posting blog articles teaching you what you need to know about tariffs on U.S. goods, which can be handy information if you’re considering buying items from the US.

In part 1, we’re taking a look at an example case of if you want to buy t-shirts from the US, and explain tariffs applied for this type of purchase and the approximate total charges.

*Only includes information on the top 5 countries for user purchases.

What is a tariff?

💡 Why do we have tariffs?

1. To protect domestic industry

2. To increase money coming in to a country (tax revenue)

3. To balance trade

If imports increase, the economy will be adversely affected, so this is also a means of adjustment.

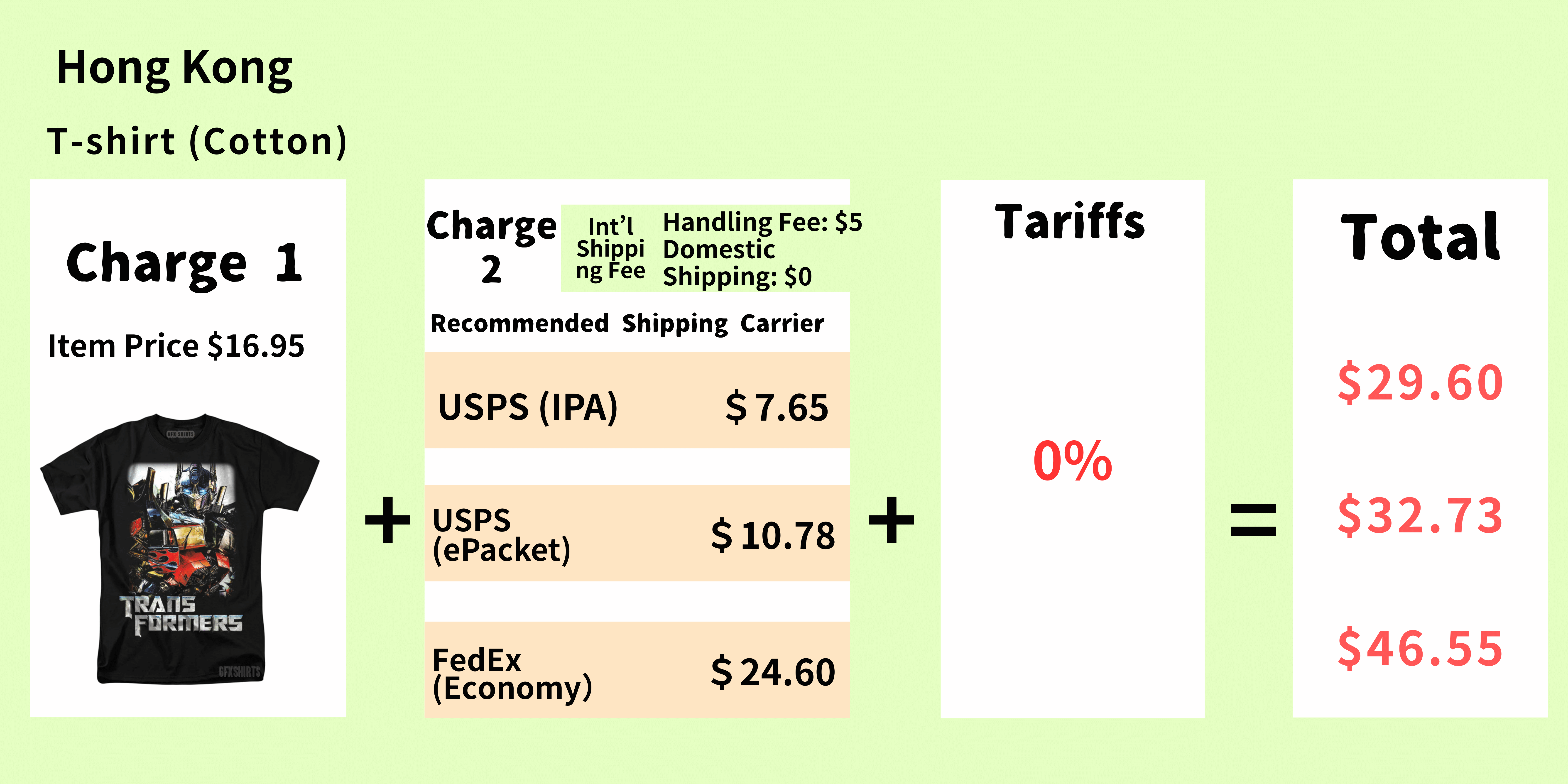

Customs duties and total charges when buying T-shirts from the US

Now let’s take a look at examples of estimated prices for items you can buy from the US!

Tariff rates for T-shirts vary depending on the material, such as cotton or silk.

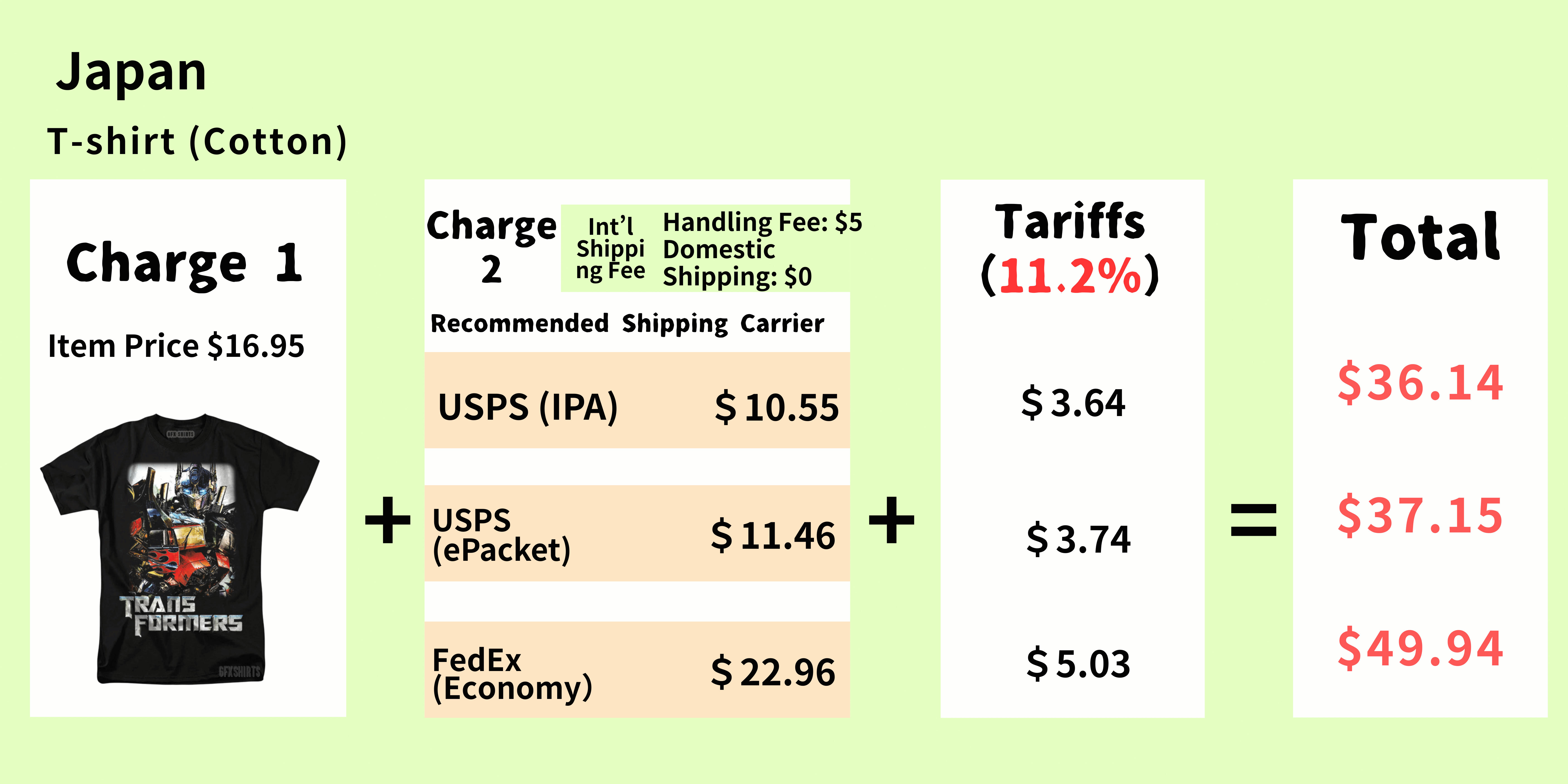

📍Shipping Destination: Japan (Tariff: 7.4% – 12.8%)

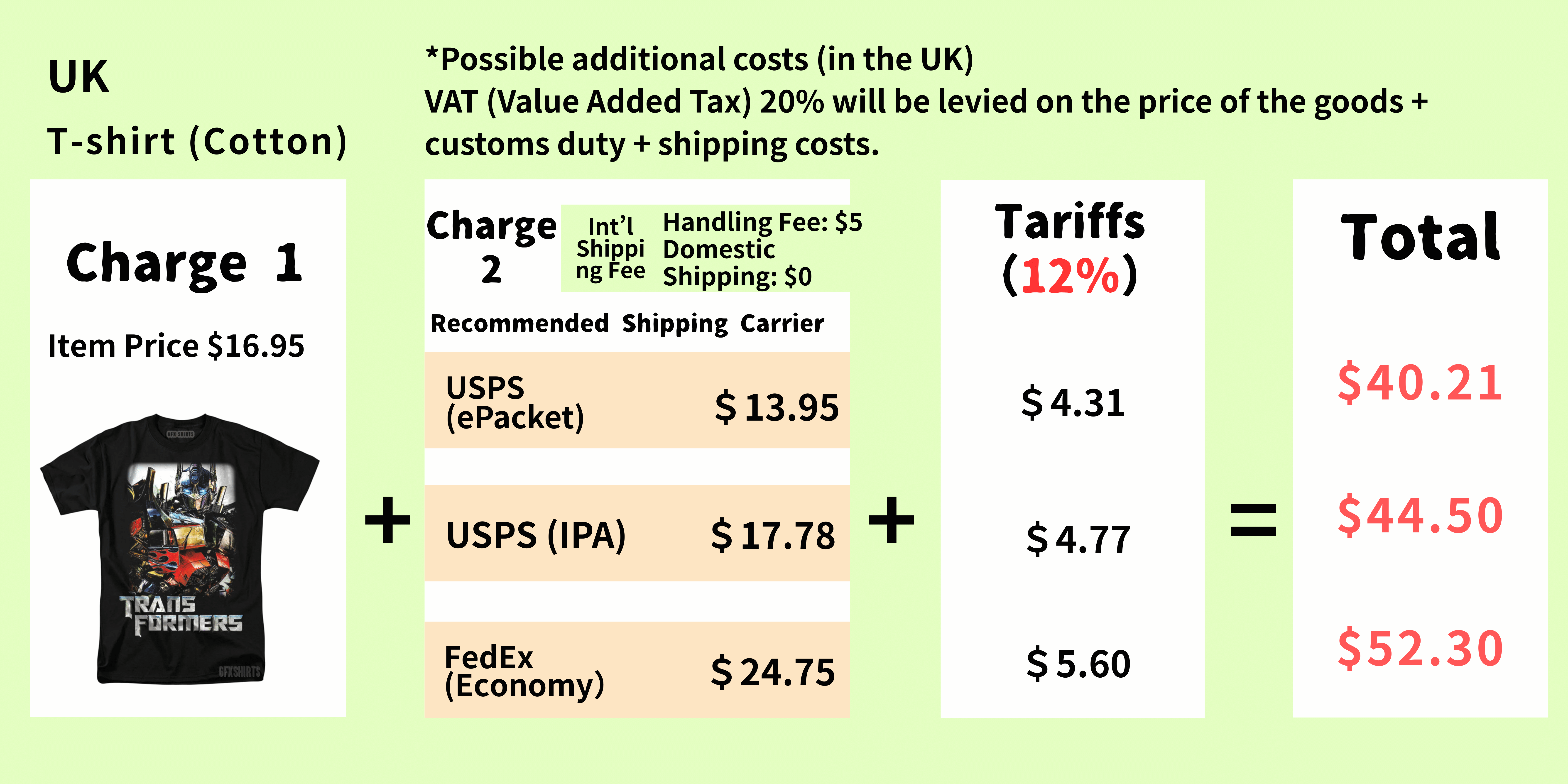

📍Shipping Destination: UK (Tariff: 12%)

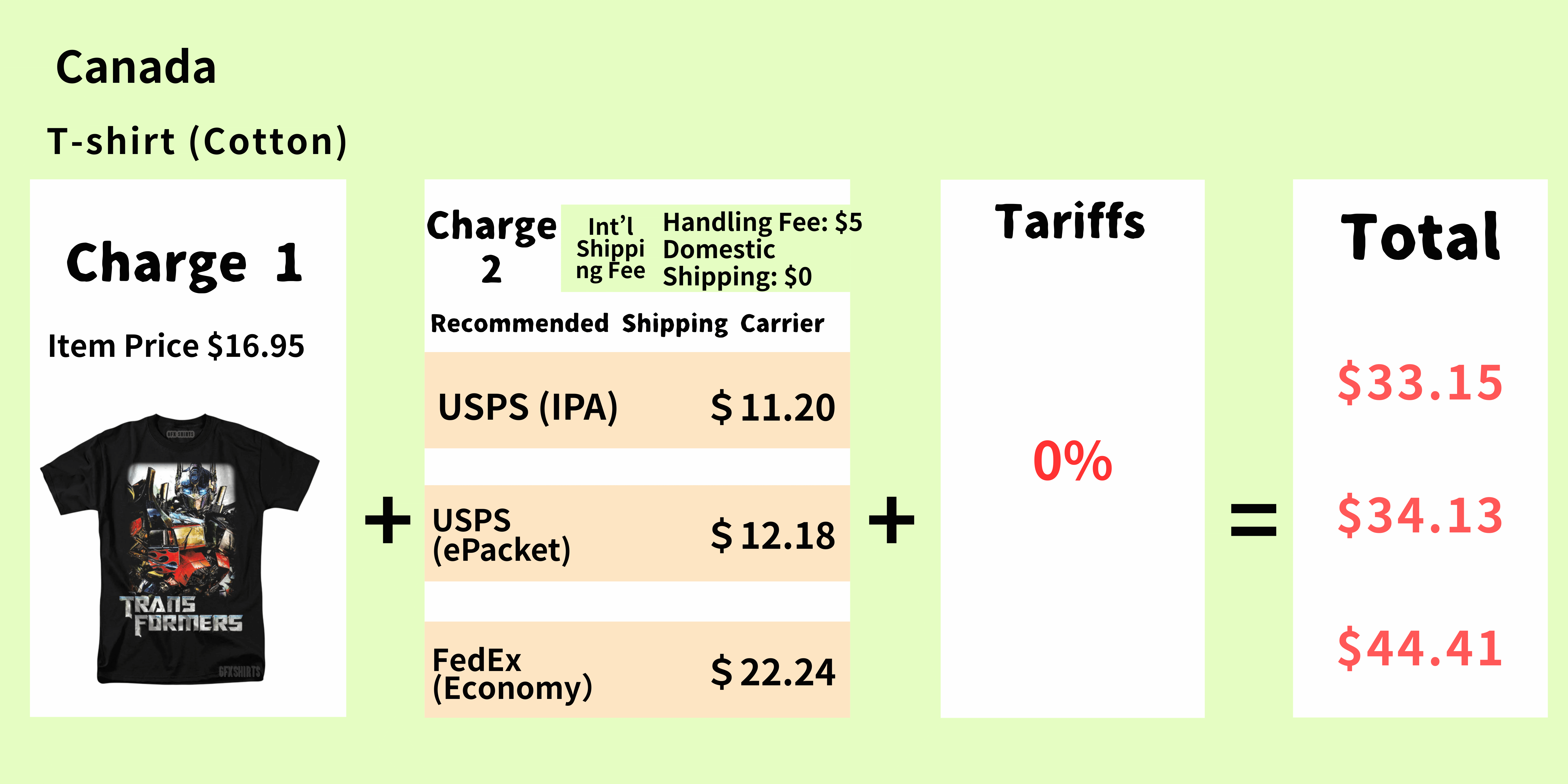

📍Shipping Destination: Canada (No tariffs)

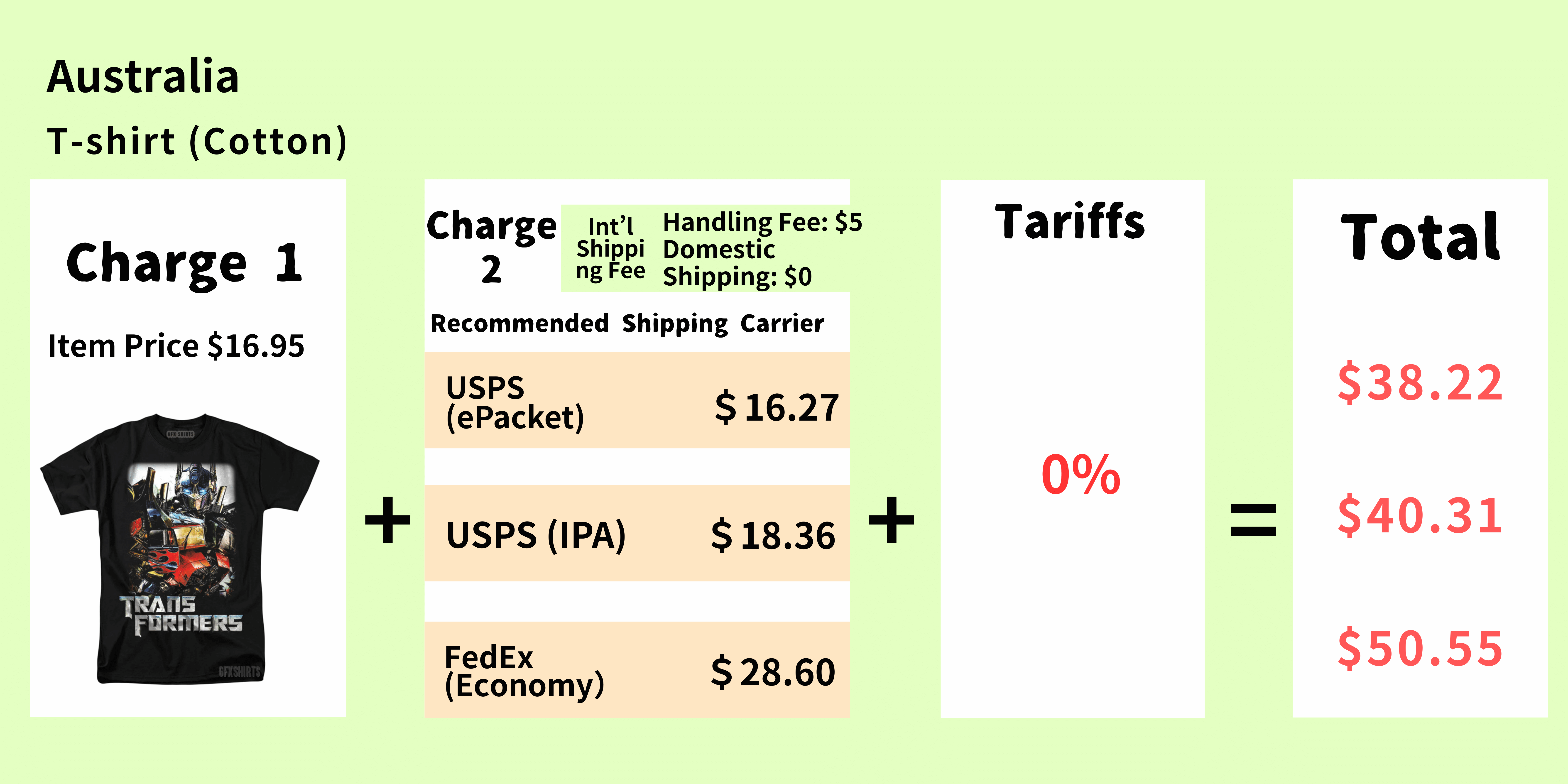

📍Shipping Destination: Australia (No tariffs)

📍Shipping Destination: Hong Kong (No tariffs)

*Please note: Tariff rates and related regulations are subject to change. Please check with the customs authorities of the importing country before shipping for the latest information. Since these are reference values for general item classification, tax rates may differ depending on the detailed HS code (tariff classification number).

Precautions by country

- United Kingdom: For details on import duty rates on US goods, please check the UK Trade Tariff Tool using the HS code. 20% VAT is standard, 0% for books, children’s goods, etc. The duty exemption limit is £135 per item.

- Japan: Clothing, leather goods, shoes, etc. are subject to customs duty and consumption tax at 10% even if the value is less than 10,000 yen. Other items with a taxable value of 10,000 yen or less are exempt from customs duties and 10% consumption tax, while items exceeding 10,000 yen are subject to the stated duties (if applicable) and 10% consumption tax.

- Hong Kong: As Hong Kong is a free port, in principle, no customs duty is imposed.

- Canada: Please note that there are different duty exemption conditions for shipments delivered by courier (FedEx, etc.) and those delivered by post office (USPS).

- Australia: GST tax (10%) is charged on our invoice 2, so you will not receive a direct invoice from the courier.

And with that, we hope you enjoy your FROM USA shopping! ♫

Check out more of our FROM USA articles below!

- A Complete Price Estimate Guide for your FROM USA Shopping

- New delivery option! You can now ship via USPS with One Map!